In Spanish property transactions, “arras” (deposit agreements) are one of the most common and, at the same time, most misunderstood elements of the process.

Although it is very common for buyers and sellers to sign a contrato de arras before the final deed of sale, not everyone fully understands what type of deposit has been agreed and what legal consequences it entails if either party fails to complete the sale.

The Spanish Supreme Court (Tribunal Supremo) has provided essential guidance on this matter, clarifying the different functions of arras and how they should be legally interpreted.

Below, we explain the three main types of deposit in Spanish law, their legal effects, and the most relevant court decisions on the subject.

1. What are “Arras” and why are they used?

The term arras (from the Latin arra) refers to a sum of money paid as a sign or guarantee when concluding a sale agreement.

In practice, the deposit is paid at the time of signing a private contract of sale, as both a commitment to buy or sell and a security for the operation.

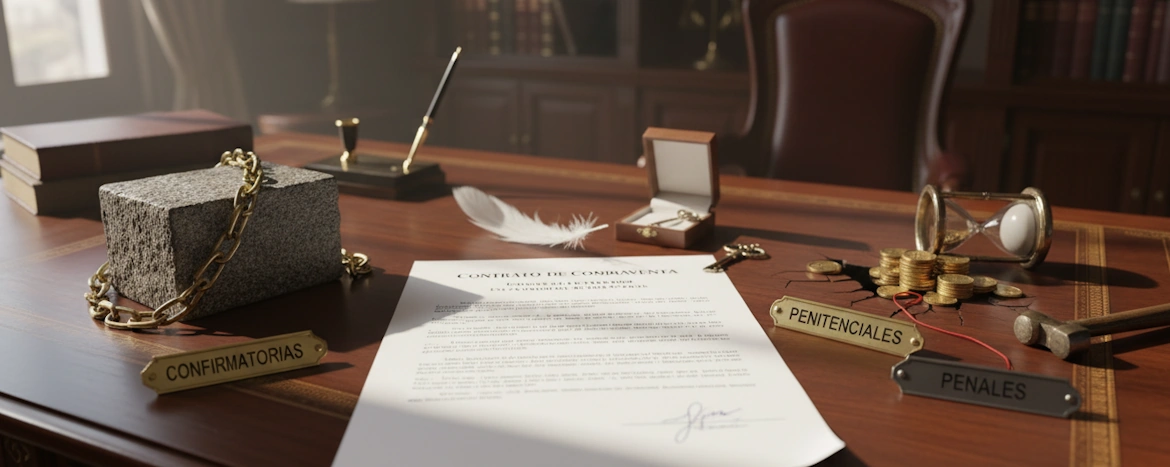

However, not all deposits serve the same purpose. Depending on how the clause is drafted, arras can be interpreted as confirmatory, penitential, or penal, each with very different legal effects.

2. Types of “Arras” under Spanish Law

Spanish doctrine and jurisprudence distinguish three main types of arras:

Let’s examine each one in detail.

2.1. Confirmatory deposits

Confirmatory arras are those delivered as part of the purchase price and serve as proof that the contract has been validly concluded.

👉 Their function is to confirm the existence and binding force of the contract.

Therefore, if one party fails to perform, the other cannot simply walk away by losing or returning the deposit.

Instead, the non-breaching party may demand fulfilment of the contract or seek its termination with compensation for damages, under Article 1124 of the Spanish Civil Code.

📘 Supreme Court Judgment, 13 June 2019:

“Confirmatory deposits do not allow either party to withdraw freely; they serve to confirm that a valid contract has been concluded, and both parties are bound to fulfil it.”

Thus, if the arras are confirmatory, the buyer or seller may require the other to complete the sale before the notary or seek termination with damages.

2.2. Penitential deposits

Penitential arras, expressly regulated in Article 1454 of the Spanish Civil Code, are the most common in property transactions.

This article provides that:

“If earnest money or a deposit has been given in a contract of sale, either party may withdraw: the buyer forfeiting the deposit, or the seller returning it double.”

This means that penitential arras grant both parties the right to withdraw from the agreement before completion, without having to justify any reason — but accepting the economic consequence:

- If the buyer withdraws, they lose the deposit paid.

- If the seller withdraws, they must return double the deposit received.

However, the Supreme Court insists that the parties’ intention must be clearly expressed in the contract.

If the wording is ambiguous, courts tend to interpret the deposit as confirmatory, not penitential.

📘 Supreme Court Judgment, 21 December 2010:

“Penitential deposits only exist when the contract clearly and unequivocally grants the parties the right to withdraw by forfeiting or returning double the deposit.”

Therefore, if the parties intend to sign penitential arras, the clause should state explicitly:

“The sum paid as a deposit shall have the character of penitential arras in accordance with Article 1454 of the Spanish Civil Code.”

2.3. Penal deposits

Penal arras act as a penalty clause (cláusula penal) to ensure compliance with the contract.

They do not confer any right to withdraw but rather serve as a sanction for breach: the party who fails to perform loses or must return double the deposit, without being released from additional liability.

📘 Supreme Court Judgment, 27 February 1992:

“Penal deposits serve to guarantee performance of the contract; the loss or double return of the deposit does not release the defaulting party from further contractual responsibility.”

This type of deposit is less frequent in property sales, as it requires careful drafting to avoid confusion with the other types and must comply with the provisions of Articles 1152 et seq. of the Civil Code.

We advise on the drafting of all types of CONTRACTS AND LEGAL ACTS.

At AGAVE ABOGADOS we advise you on the entire purchase and sale process, especially the drafting of the earnest money contract.

3. How the Spanish Supreme Court interprets “Arras”

Over the years, the Supreme Court has developed a consistent approach to interpreting deposit clauses, based on the following principles:

1. Restrictive interpretation of withdrawal rights

Penitential arras will only be recognised when the contract expressly and clearly grants the right to withdraw. Otherwise, they are presumed to be confirmatory (STS, 24 May 2017).

2. Literal wording prevails:

Courts focus primarily on the contract’s wording. If the deposit is described as “part of the purchase price” or “on account of the total”, it is confirmatory.

3. Parties’ actual intention and purpose

If the deposit is intended to secure performance, not to allow withdrawal, it is deemed confirmatory or penal, depending on context.

4. Good faith and subsequent conduct

The parties’ behaviour after signing — such as insisting on completion or setting completion dates — can influence the court’s interpretation.

In short, the legal nature of the deposit does not depend on the label “arras”, but on the true intention of the parties and the contract as a whole.

4. Legal advice when signing a deposit contract:

At AGAVE ABOGADOS, specialists in Real Estate and Contract Law, we recommend taking the following precautions before signing a deposit agreement (contrato de arras):

Define clearly the type of deposit agreed (confirmatory, penitential, or penal).

Cite Article 1454 of the Civil Code explicitly if penitential arras are intended.

Specify deadlines and conditions for signing the public deed before the notary.

Seek legal review of the contract by an independent lawyer before signing.

Avoid generic online templates, which often omit key legal details or create ambiguity.

A single poorly drafted clause can determine whether the buyer recovers the deposit or the seller must return double — a significant financial difference.

5. Conclusion

The contrato de arras is a useful and widely accepted tool in Spanish property transactions, but its legal effects vary greatly depending on which type of deposit is agreed.

Spanish jurisprudence draws clear distinctions between confirmatory, penitential and penal deposits, and courts will interpret each case based on the parties’ true intention and the wording of the clause.

Before signing any deposit contract, it is crucial to obtain specialised legal advice to ensure that the terms reflect your interests and comply with Spanish law.

At AGAVE ABOGADOS, we advise both buyers and sellers in all aspects of the property purchase process — from drafting and reviewing deposit contracts to notarial coordination, tax advice, and title registration — ensuring full legal security throughout the transaction.